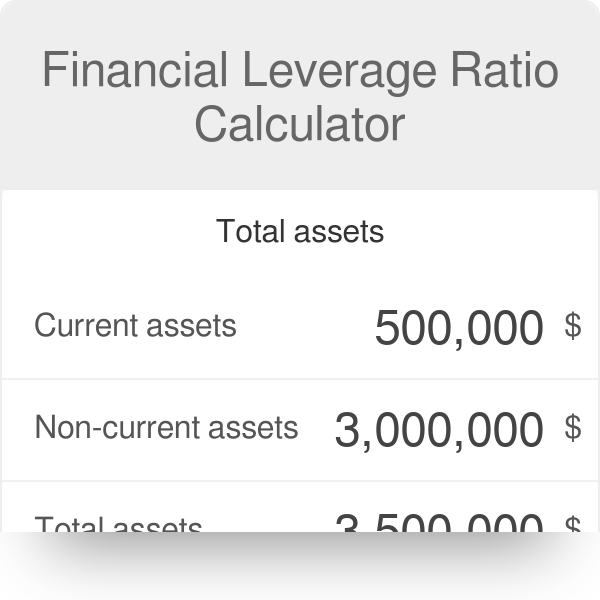

Financial leverage calculator

This article has been a guide to Equity Multiplier Formula practical examples and equity multiplier calculator along with excel templates. A Leverage Ratio measures a companys inherent financial risk by quantifying the reliance on debt to fund operations and asset purchases whether it be via debt or equity capital.

Financial Leverage Formula Calculator Excel Template

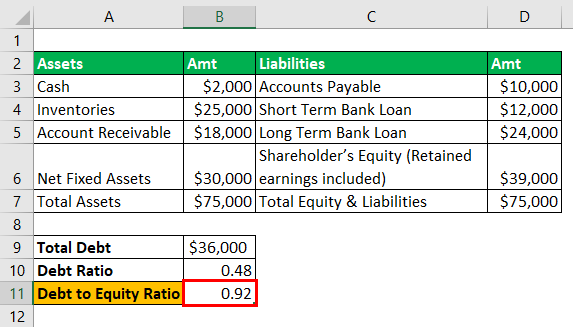

In general if a companys DE ratio is too high that signals that the company is at risk of financial distress ie.

. The uses of the financial leverage equation are as follows. Trading calculator also referred to as forex calculator leverage calculator leverage trading calculator is a versatile tool which may prove useful to both beginners and professionals of financial markets. We offer a calculator which makes it easy to compare fixed vs ARM loans side-by-side.

For example for a USD account with leverage 1100 and the current forex prices as of writing the margin cost would be. The Reserve Bank of Indias RBIs latest digital lending guidelines has stepped up pressure on new age lending businesses forcing them to focus on their non-banking financial company NBFC units and book building as the regulator gives importance to regulated entities. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

The Margin Requirement is 001 or 1. Perhaps financial pessimists are doomed to financial mediocrity. It helps in taxation by reducing the net cost of borrowing as interest expense is tax-deductible.

However a low DE ratio is not necessarily a positive sign as the company could be relying too much on equity financing which is costlier than debt. For our example we will select a leverage of 301. The calculator will use the current real-time prices for exact values.

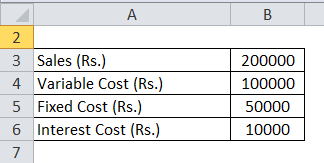

As per this approach the WACC and the total value of a company are independent of the companys capital structure decision or financial. Conforming loans have a price limit set annually with high-cost areas capped at. Let us take the example of another Company ABC Ltd which has a clocked net income of 200000 as per the last reported annual result.

Educate yourself on the risks associated with foreign exchange trading and seek advice from an independent financial or tax advisor if you have any. These include repair and maintenance expenses and methods of figuring leveragethe amount of money borrowed with interest to make the initial investment. Hit Calculate After you click Calculate you will see the results below.

Currency pair - the currency youre trading. Leverage and margin refer to the same concept just from a slightly different angle. What is a Leverage Ratio.

Margin Requirement 1 Leverage Ratio. You can consider a cash-out refinance to help leverage the existing equity in your home to finance home improvement projects. Check ask and bid prices.

However no guarantee is made to accuracy and the publisher specifically. The Net Income Approach suggests that with the increase in leverage proportion of debt the WACC decreases and the firms value increases. Next we click the Calculate button.

Each calculator available for use on this web site and referenced in the following directories - finance calculator retirement calculator mortgage calculator investment calculator savings calculator auto loan calculator credit card calculator or loan calculator - is believed to be accurate. Also famous as the traditional approach Net Operating Income Approach suggests that the change in debt of the firmcompany or the change in leverage fails to affect the total value of the firmcompany. MMM January 13 2012 909 am.

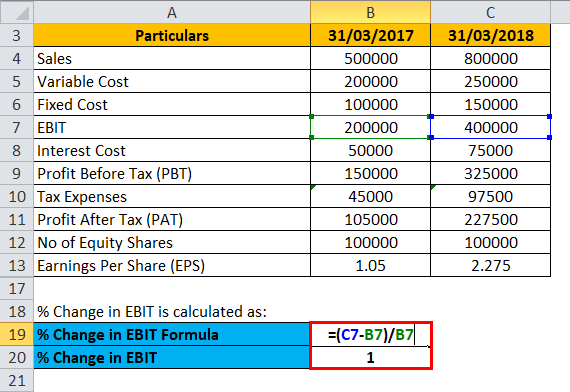

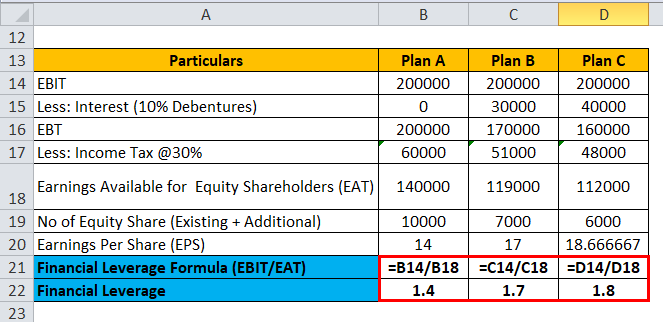

Get 247 customer support help when you place a homework help service order with us. For example your leverage is 11000. Therefore a 1 change in XYZ Ltds leverage will change its operating income by 111.

Of course financing terms can greatly. It helps to know the financial risks of the company. Credit Analysis Ratios Leverage Ratio Interest Coverage Ratio Solvency Ratio Debt to Equity Ratio DE Net Debt Times Interest Earned TIE Ratio Cash Flow Available for Debt Service CFADS Debt Service Coverage Ratio DSCR Debt Capacity Debt Covenants Collateral Default Risk Loss Given Default LGD Fixed Charge Coverage Ratio FCCR.

In this field traders just need to input a leverage ratio. At risk of being unable to meet required debt obligations. Using the Trading calculator traders have an opportunity to make online calculations of transaction parameters choose more efficient.

Financial leverage also helps in making major decisions for a company. 001 1 100. This is a shift for the digital lending industry which has largely focused on growing the lending.

A leverage ratio calculation is complex however with our forex leverage calculator you just need to input a few values and calculate it easily. As you can see leverage has an inverse relationship to margin. Alternatively youll reach your goal in after-inflation terms todays dollars in 2055.

A loans AMORTIZATION period is the amount of time over which the loans payment is calculated. A cash-out refinance can also help you use the money youve already paid into your mortgage to do things like cover repair bills consolidate to pay off debt or even eliminate your outstanding student loans. There you have it.

Financial leverage is used in corporate capital structuring. Trade with leverage and tight spreads for better returns on successful trades. In this industry it is common for loans to have a split amortization meaning that the loans term and amortization periods are different Amortization Period being greater than or equal to the Term never less.

You may insert your preferred askbid prices or let the calculator use the latest prices set by the market. Why is margin important. For example if the Leverage Ratio is 1001 heres how to calculate the Margin Requirement.

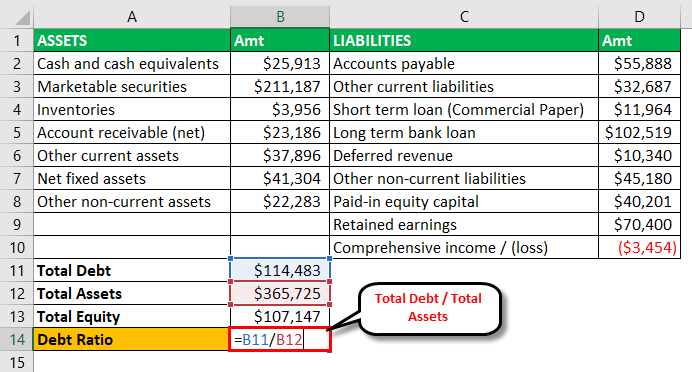

Typically the debt incurred by the company is compared to metrics related to cash flow assets and total capitalization which collectively help gauge the companys credit risk. Businesses widely use leverage to fund their growth families apply leveragein the form of mortgage debtto purchase homes and financial professionals use leverage to boost their investing. Heather banks are complicated businesses and they get to employ leverage on your deposits to get greater returns plus they have various consumer fees consultancy and brokerage stuff and other.

According to Net Income Approach a change in the financial leverage of a firm will lead to a corresponding change in the Weighted Average Cost of Capital WACC and the companys value. You may also have a look at these articles below to learn more about Financial. It is a financial leverage ratio that helps determine how the shareholders equity finances many assets of the firm.

At least Im relatively thrifty by nature. Specify the leverage that you use for trading. Based upon the numbers above you will be a millionaire in 30 yearsIf you start today that means youll reach your goal in before-inflation terms in 2051Your million dollar savings will be worth 741923 in todays dollars inflation adjusted at that time.

Conforming loans have a price limit set annually with high-cost areas capped at 150 of the base cap. This could be the current leverage offered by the broker or any other ratio from as little as 11 to 60001 to simulate the amount of margin used to open a position. Our pip calculator helps you to estimate the pip value in your trades so that you can better manage your risk.

Financial Leverage Formula Calculator Excel Template

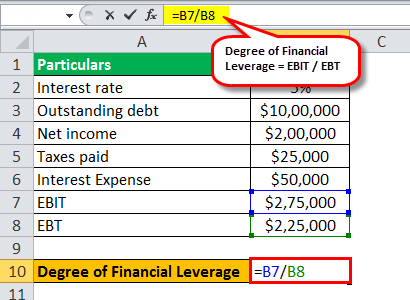

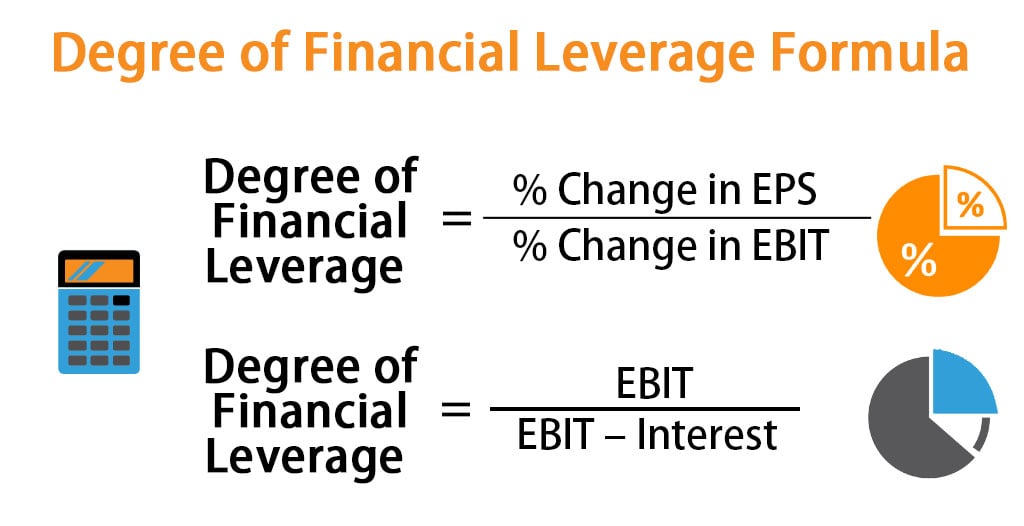

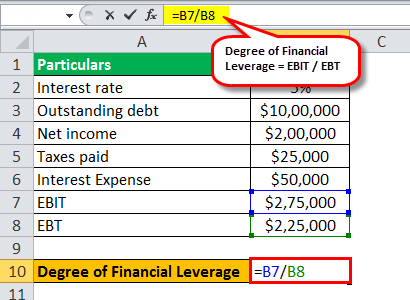

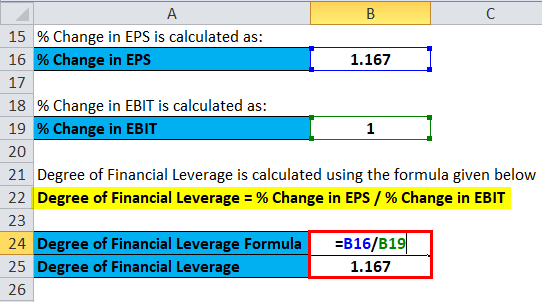

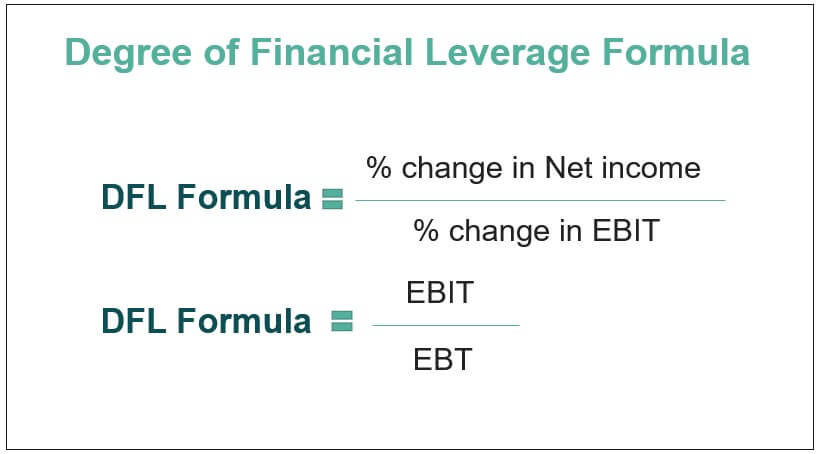

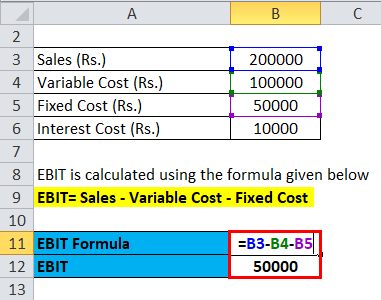

Degree Of Financial Leverage Dfl Formula And Calculator Excel Template

Operating Leverage Why It Matters How To Calculate It Penpoin

Operating Leverage Formula And Calculator Excel Template

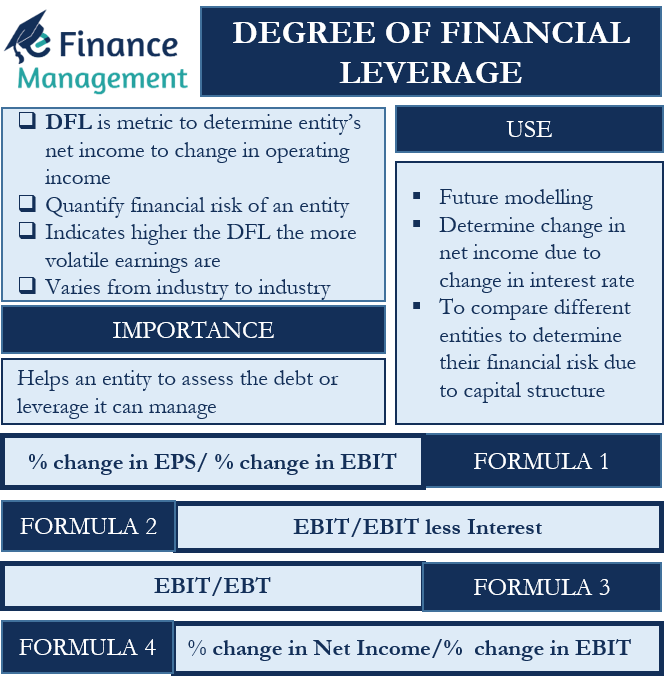

Degree Of Financial Leverage Importance Uses And Formula Efm

Degree Of Financial Leverage Formula Calculator Excel Template

Degree Of Financial Leverage Formula Step By Step Calculation

Financial Leverage Formula Calculator Excel Template

Leverage Ratios Formula Step By Step Calculation With Examples

Financial Leverage Ratio Calculator Formula

Leverage Ratio Formula And Calculator Excel Template

Leverage Ratios Formula Step By Step Calculation With Examples

Financial Leverage Formula Calculator Excel Template

Operating Leverage Formula And Calculator Excel Template

Financial Leverage Formula Calculator Excel Template

Degree Of Financial Leverage Formula Step By Step Calculation

Financial Leverage Formula Calculator Excel Template